Philosophy & Process

Our core investment philosophy is straightforward: Earnings growth drives stock prices over the long term. We believe investing in high-quality, growing businesses leads to superior risk-adjusted returns. Our long-term perspective allows us to look past short-term volatility. We trust our extraordinarily in-depth fundamental research to find companies poised to achieve long-duration growth.

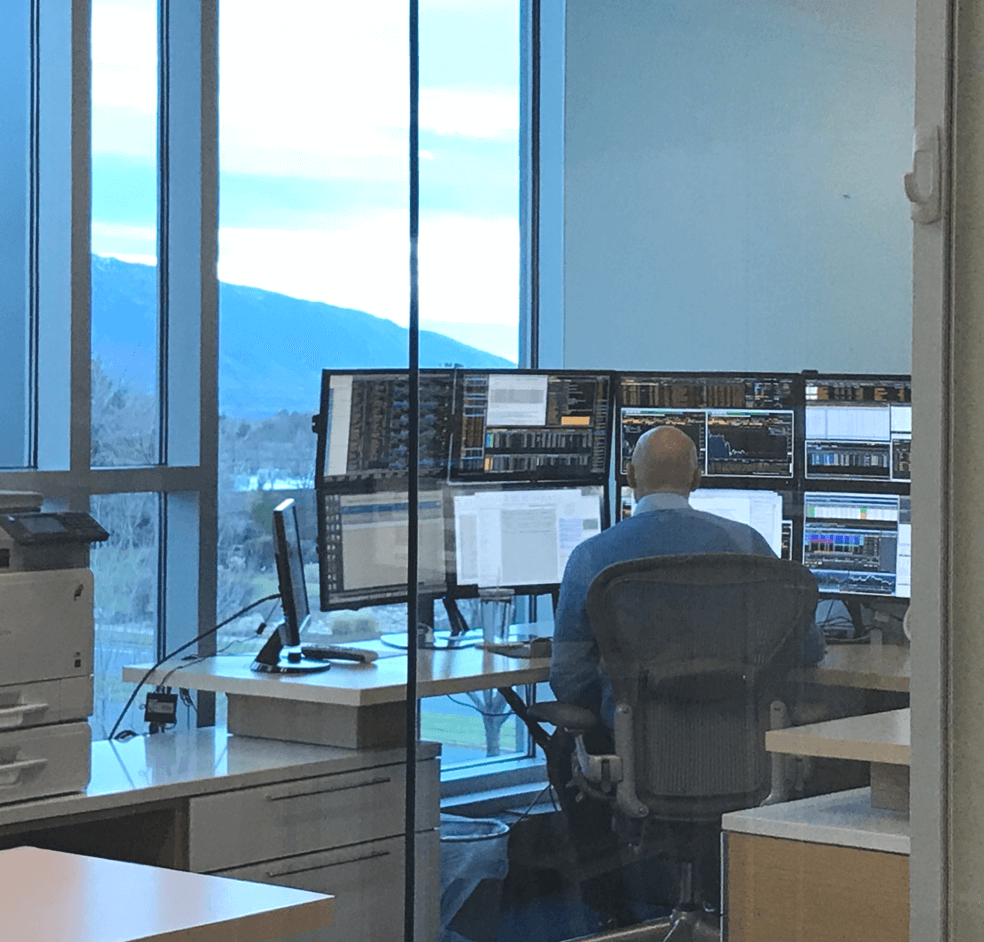

Comprehensive Research

Our consistent research process is a highly integrated effort across our entire research team. We start with proprietary screening methods and tools that identify consistent earnings growth, strong cash flows and above-average returns on capital. We continue to narrow the universe using our bottom-up, fundamental process, seeking truly exceptional businesses with the potential for sustainable growth.

Evaluating Management

Our subjective evaluation of management teams is a critical step in our process—and has many times proven to be our most effective predictor of future stock performance. Our extensive experience helps us to differentiate between good management teams and exceptional ones. We believe this is absolutely critical to delivering long-term results—and a key area where active management has the potential to outshine an approach constrained by quantitative evaluation alone.

Multiple Eyes

“Multiple Eyes is not just teamwork – it’s debating, analyzing and working together. It’s one step above teamwork. It’s an engaged team, an open team.”

The primary tenet of our collaborative process is our Multiple Eyes™ approach. At every junction in our research and decision-making process, we believe that two sets of eyes are better than one—and three are even better. When Multiple Eyes™ is at its best, the result is an open and engaged team, building conviction for investment ideas.

Multiple Eyes is a step above teamwork. It’s having an engaged and open team, where debate is an aspect of cooperation. Every voice within the firm is valued, and the diversity of backgrounds and perspectives in our internal discussions lead us to sharp and deliberate conclusions.

Global Perspective

Esvee CAPITAL is committed to finding the most promising companies in the world, wherever they may be. A ESVEE cornerstone has always been the deep due diligence applied to each investment we make. To take full advantage of the inefficiencies and opportunities available in global markets, analysts must be willing to roll up their sleeves and travel frequently in order to gain a true understanding of the companies and their markets.

We generate almost all of our research internally, while also conducting extensive screening and traveling globally to find high-quality growth companies that have not been discovered or properly understood by Wall Street. Management teams regularly mention to us just how rare it is for them to actually get a visit from an analyst.